The Latest News and Updates from KerberRose

Resources

Planning Financial Futures

Do you spend more time planning your annual vacation than you do thinking about your personal finances? If so, you’re not alone. A lot of people put off financial planning or avoid it altogether.

Retirees’ Retirement Asset Withdrawal Rate: Will Your Money Last?

For many years the investment advisory community has proposed if retirees withdrew their retirement assets at the rate of 4% annually, there is a high probability assets would last to normal life expectancy

Every Plan Should Have a Committee Charter and Here’s Why

Although not legally required by ERISA, a retirement plan committee charter is a very important document for plan governance which may help fiduciaries avoid potential liabilities. Committee Charters are one effective way to “evidence” intent of prudent plan management. Having a charter is a “best practice” all plan sponsors should seriously consider.

Survey Says… What’s Your Take on Financial Wellness Programs?

A recent comprehensive TIAA survey of financial wellness plan participant perceptions may be helpful to plan sponsors who have, or are considering implementing, a wellness plan for their employees.

What’s the Magic Number When it Comes to Record Retention?

You don’t need to be a magician to know what records to keep and for how long. While most providers can supply reports and plan documents, the plan administrator remains ultimately responsible for retaining adequate records that support the plan document reports and filings.

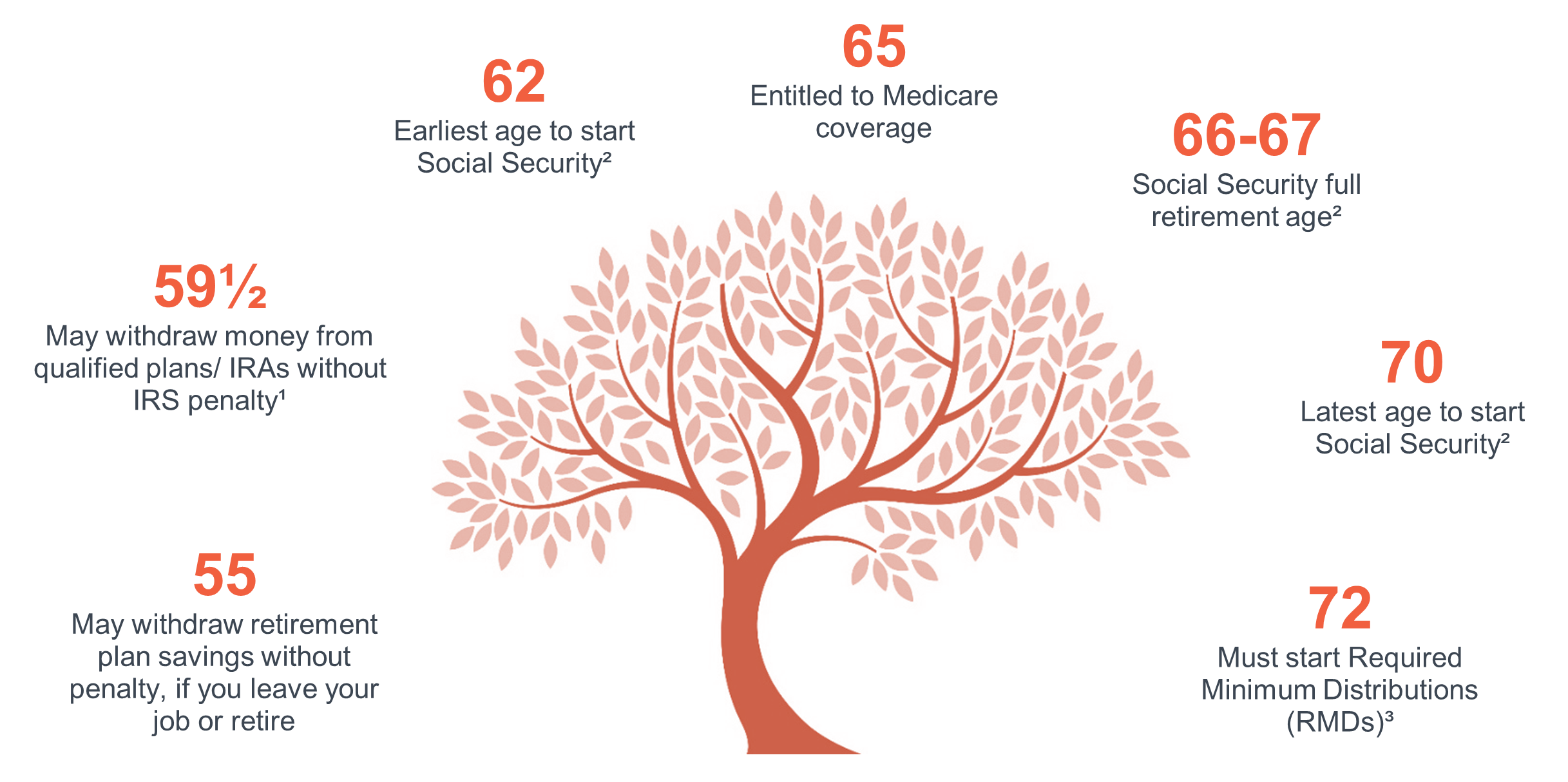

Key Dates as You Approach Retirement

At what age can retirement plan distributions begin? When can a person begin to receive Social Security?

Thanks for the Memories: Gratitude and Financial Wellness

So much about financial wellness has to do with cultivating a mindset favoring delayed versus immediate gratification. In the language of behavioral economics, the tendency to prefer short-term rewards is called hyperbolic discounting.

What is an appropriate interest rate for plan loans?

Both ERISA and the IRS require DC plan loans to reflect a “reasonable rate of interest”.

ERISA 3(38) Fiduciary Services

Most organizations’ human resource departments and C-suites are seeking efficiencies and risk mitigation for their entities. For these, and a myriad of other, reasons, plan sponsors are giving 3(38) fiduciary discretionary investment management services a closer look.

Good Vibrations

A recent survey of retirement plan participants shines a light on their positive perspectives – which can help inform plan changes you may be considering.

Student Loan Repayment Program

On August 17, 2018, the IRS issued private letter ruling 201833012 (the PLR). The PLR addressed an individual plan sponsor’s desire to amend their retirement plan to include a program for employees that were making student loan repayments. The form of this benefit would be an employer non-elective contribution (SLR contribution).