Consider Making a Catch-Up Contribution to Your Retirement!

When am I eligible to make a catch-up contribution?

If you turn age 50 anytime in the calendar year, you are eligible to contribute an additional $7,500 into your plan as a catch-up contribution. This is in addition to the $22,500 annual limit.

Is the catch-up contribution pre-tax or Roth?

Either type of savings are available for your catch-up contribution. Depending on your income, the Secure Act 2.0 may require a change for your situation to Roth (more information to follow).

What does this all mean?

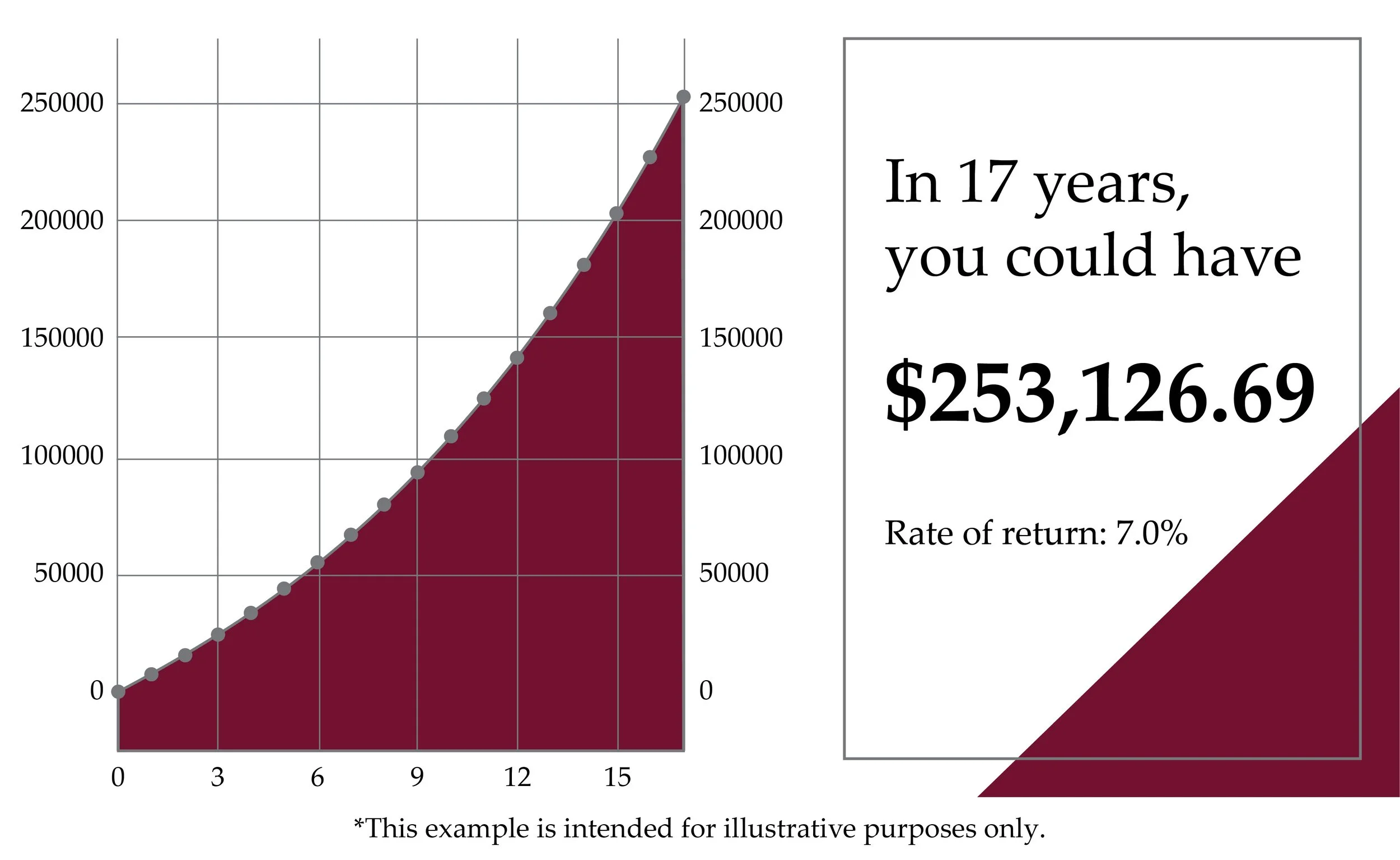

If you wish to save an additional $7,500 per year, you can accumulate over $250,000 in the next 17 years! As the limits to save increase, you may be able to save even more each year. For more information, contact KerberRose Retirement Plan Services at (715) 524-6626 or 401kservices@kerberrose.com.