Tax Saver’s Credit: Get the “Credit” You Deserve!

You may be eligible for a valuable incentive – which could reduce your federal income tax liability – for contributing to your company’s 401(k) or 403(b) plan. You may qualify to receive a Tax Saver’s Credit of up to $1,000 ($2,000 for married couples filing jointly) if you made eligible contributions to an employer sponsored retirement savings plan. The deduction is claimed in the form of a non-refundable tax credit, ranging from 10% to 50% of your annual contribution.

Remember, when you contribute a portion of each paycheck into the plan on a pre-tax basis, you are reducing the amount of your income subject to federal taxation. Those assets grow tax-deferred until you receive a distribution. If you qualify for the Tax Saver’s Credit, it may reduce your taxes even more.

Your eligibility depends on your adjusted gross income (AGI), your tax filing status and your retirement contributions. To qualify for the credit, you must be age 18 or older and cannot be a full-time student or claimed as a dependent on someone else’s tax return.

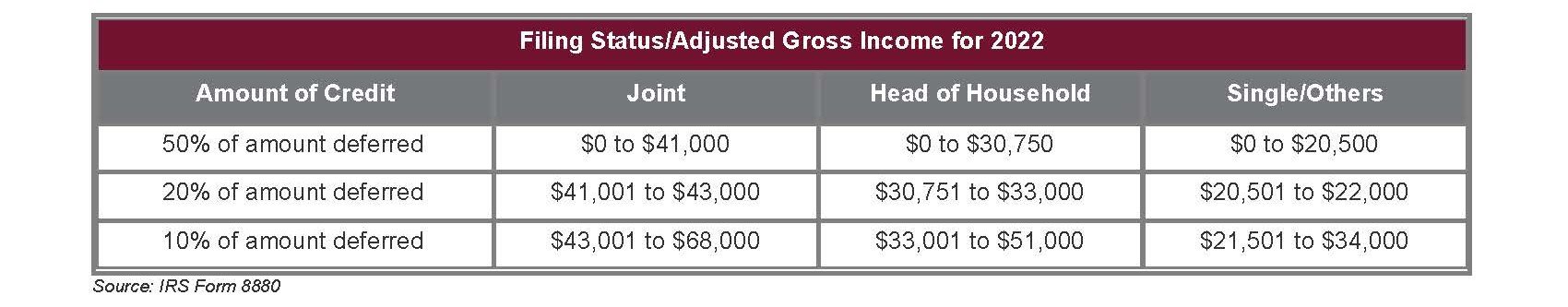

Use the chart below to calculate your credit for tax year 2022. First, determine your AGI – your total income minus all qualified deductions. Then, refer to the chart to see how much you can claim as a tax credit if you qualify.

For example:

A single employee, whose AGI is $17,000 and defers $2,000 to their retirement plan, will qualify for a tax credit equal to 50% of their total contribution. The employee’s tax bill will be reduced by $1,000.

A married couple, filing jointly with a combined AGI of $42,000 each contributes $1,000 to their respective retirement plans (for a total contribution of $2,000), will receive a 20% credit. Their tax bill will be reduced by $400.

With the Tax Saver’s Credit, you may owe less in federal taxes the next time you file by contributing to your retirement plan today!

For more information, please contact a KerberRose Trusted Retirement Advisor at (715) 524-6626 or 401kservices@kerberrose.com.

Distributions before the age of 59 ½ may be subject to an additional 10% early withdrawal penalty. This is for informational purposes only; we suggest that you speak with a tax professional about your individual situation.